Can You Pay Off a Credit Card Before the Due Date Comes

Editorial Note: The content of this article is based on the author'south opinions and recommendations alone. It may non have been reviewed, approved or otherwise endorsed by the credit bill of fare issuer. This site may be compensated through a credit card issuer partnership.

Citi is an advertizing partner

Whether you've been using credit cards for years or you're applying for your offset one, they can be confusing. Depending on how you use them, credit cards can either be incredibly dangerous or immensely helpful. This guide will walk you through what you need to know about using a credit card, building credit and earning rewards.

How to use a credit card: The iv principles to master

Yous should e'er handle credit cards with extreme care. Dissimilar debit cards, you're making purchases on credit — meaning you're 100% liable for paying dorsum everything y'all charge to your credit carte du jour. If y'all aren't conscientious, you tin terminate up in a lot of debt.

There are iv main principles to becoming a credit card master. If you accept away annihilation from this guide, you should always follow the first dominion — pay your bill on time and in total every single month. This strategy alone will help your personal finances tremendously.

If you'd like to larn other ways to maximize your credit card use, read on for the all-time practices for managing your credit card.

Dominion #ane: Always pay your nib on time (and in full)

The nigh of import principle for using credit cards is to ever pay your pecker on time and in full. Following this simple rule can assistance you avoid interest charges, late fees and poor credit scores. By paying your bill in full, you'll avert interest and build toward a high credit score.

The consequences of missing a payment

By consistently missing payments, you could end up paying hundreds of dollars in late fees. The negative consequences spiral — once your credit score takes a hit, you could face up thousands in involvement when applying for futurity mortgages or loans. If yous're unable to pay your beak on time, information technology may be time to cut up your card.

You lot're ordinarily given multiple options to pay your credit bill of fare statement each month. While information technology may be tempting to pay just the minimum payment — which could be as low as $25 — you'll get-go to accrue involvement, leading to years of debt. The best exercise is to pay off your credit menu neb as soon as you make a buy. This fashion, you lot can get into the addiction of paying your bill long before its due date.

Each month, your issuer will provide your credit carte du jour statement with two dates: the closing date and payment engagement:

- The closing appointment is the final twenty-four hour period you lot can make a charge for a monthly argument. Subsequently the closing appointment, whatsoever new transaction will go onto next month'due south statement.

- The payment date tells yous when the payment for a particular argument is due.

In the example to a higher place, this user has a closing date of Jan. 16 and a payment date of February. 13. This monthly statement ran from December. 17 to January. xvi, with a payment due on Feb. 13. In this case, yous take a 28-day grace period subsequently your argument date before you're required to make a payment. Y'all won't exist charged any involvement during this grace period as long as y'all pay in full by the due date.

All credit cards are different and volition have varying billing cycles, payment dates and grace periods. Review the information for your credit carte to understand how it works for your situation. If you're having trouble remembering to pay your bill, well-nigh issuers will allow yous to gear up automatic payments or schedule reminders each calendar month.

Rule #two: Keep your balances depression by only charging what you can afford

In add-on to making on-fourth dimension payments, it's essential to keep your residual low relative to your available credit limit. In that location are two main benefits to maintaining a small rest:

- Low balances help increase your credit score.

- Yous're more than probable to pay off your balance in full and on time.

Many factors determine your credit score, but a significant portion (30%) comes from your credit utilization. In other words, this is the ratio of what you owe to your full credit limit. For instance, if you have a credit limit of $1,000 and charge $500 to your card, your credit utilization would be 50%.

While there's no clear definition of your credit utilization, experts believe that yous should keep information technology under 30%. Anything higher than that can decrease your credit score. To achieve a low credit utilization ratio, you should typically accuse less than you lot can afford. By keeping a depression balance, you minimize the take a chance that you'll spend more than you can pay off at the end of the calendar month.

Finally, don't view your credit card as an extension of your budget. You should never charge more than what you tin can currently embrace in your bank account. Information technology's tempting to spend ahead based on what you lot know you'll become paid, but it's a bad do. If you lose your task or encounter an emergency, y'all won't be able to cover those charges. People don't intend on having credit card debt — it builds slowly and becomes a vicious cycle that becomes difficult to break.

Rule #iii: Empathize how involvement is calculated

Opposite to popular belief, involvement isn't calculated based on the remaining residue after making a minimum payment. In reality, issuers calculate interest based on your average daily rest, calculated by taking your card'due south Apr (Annual Percentage Rate) and dividing this number by 365.

For example, presume you take a argument residuum of $1,000 and brand a payment of $800 on the due date. You lot'll be charged involvement on the remaining balance of $200 and lose your grace menstruation. In the new billing wheel, whatever transactions will begin accruing interest immediately. The grace period where no involvement is charged merely applies if you lot pay your balance in full past the payment appointment.

Dominion #iv: Monitor your monthly argument

Monitoring your statement helps you cheque for fraud, stay on a budget and maintain a low remainder. Fifty-fifty if y'all've set upwardly an automatic payment, information technology's still wise to log in and check your statement every month to ensure there are no suspicious transactions.

Thankfully, most issuers have sophisticated technology that checks for fraudulent charges, but they may not catch them all. At to the lowest degree once a month, you should bank check your argument and verify there aren't any purchases you don't recognize.

In addition to checking for fraudulent activity, monitoring your statement will help you stay on budget. There's no way to know if you're maintaining a depression residuum, keeping your spending in check, or blowing the budget unless you're regularly checking in.

How to use a credit card to build credit

Equally the name suggests, credit cards are one of the foremost tools for building a credit score and can make a great foundation for your credit history. The all-time fashion to build your score using credit cards is to follow the recommendations listed above: Pay on time and in total, and keep a low residue. Beneath, yous'll learn how credit scores are calculated and exactly how credit cards bear upon them.

Know how your credit score is calculated

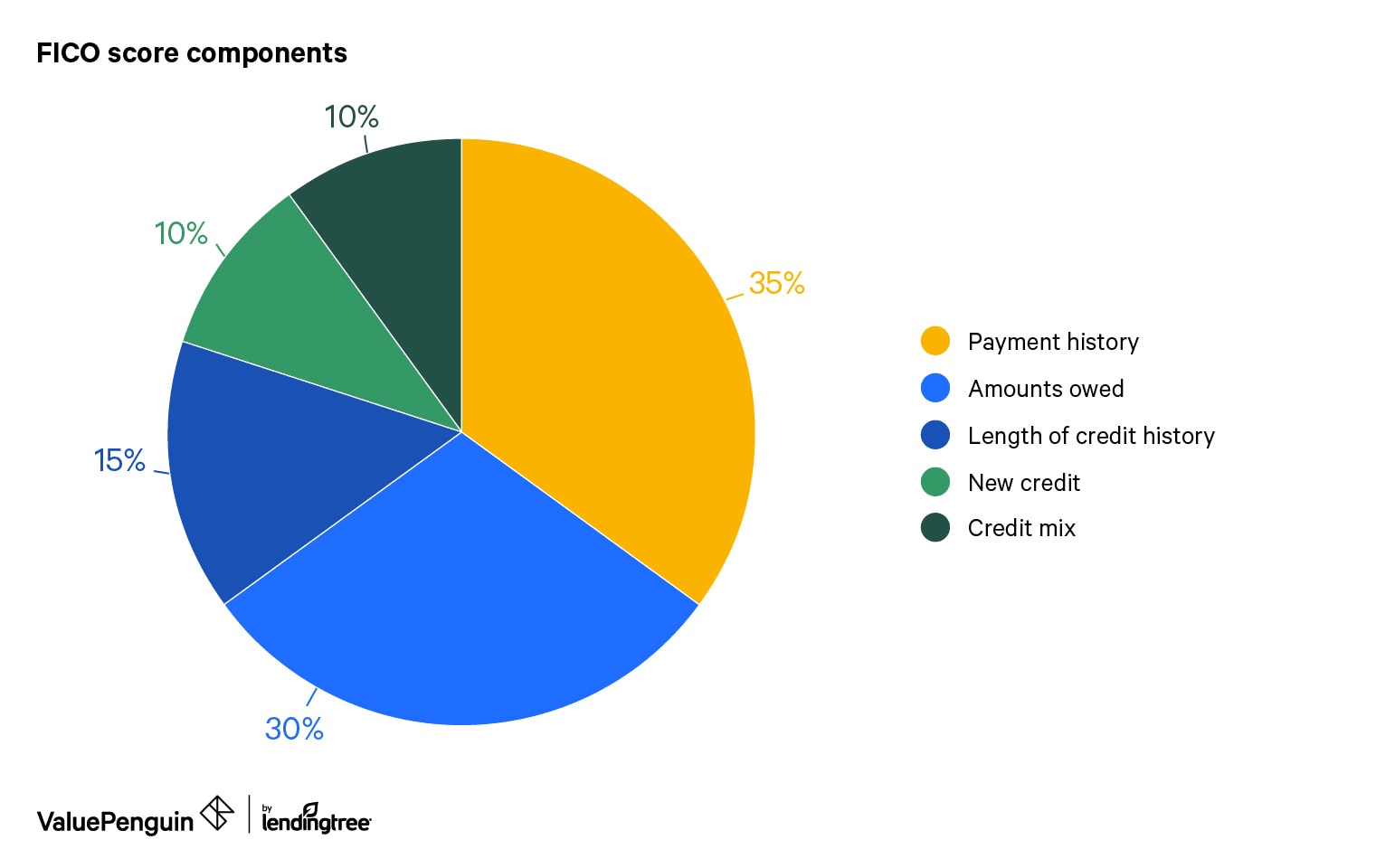

The FICO Score is the nearly commonly used credit score that most lenders refer to and is fabricated upward of five cardinal components:

- Payment history is determined by how oftentimes y'all pay on time and how reliable you are as a borrower.

- Credit utilization is the ratio between how much you borrow (rest) to how much is available to you (credit limit).

- Length of credit history is how long you've used credit — the longer, the better.

- New credit is how frequently you utilise for credit products or loans, and what percentage of your credit comes from recently opened accounts.

- Credit mix is how many dissimilar types of credit you lot utilise.

FICO Scores range from 300 to 850, and the boilerplate score is 701. It takes time and patience to build your credit score. Since the length of credit history determines 15% of your score, it'southward a good idea to beginning early and learn how to manage your credit properly.

Other strategies to assistance you build your credit score

Payment history and credit utilization make up 65% of your score. Because these two factors solitary comprise the majority of your score adding, you should maintain a low balance and never miss a payment to beef upwardly your score. If yous're already following these principles, here are four more strategies to assistance you build your credit score:

- Never abolish your first credit carte du jour. Unless it has an annual fee, you want to go along your oldest line of credit as long as possible, as this will help your boilerplate account age.

- Ask for a credit-limit increase, but don't increase your spending. Telephone call your credit menu company for a credit-limit increase if you want to reduce your credit utilization ratio. This tactic volition assist your utilization score past decreasing your ratio.

- Open a new credit carte and then gear up a recurring nib and automatic payment to that menu. Setting up this minor recurring payment (such as a streaming subscription) will assistance both your overall utilization and your payment history.

- Pay off all your credit cards a few days before each statement closes if you lot're applying for a loan soon. Paying off your cards early on will decrease your overall utilization and boost your credit score for a few days.

How to employ a credit card to earn cash back and rewards

Earning rewards from a credit card is the fun function. Merely start, you should consider what your top spending categories are, then pick a card that will provide the best returns for you. Everyone'due south spending habits are different — some people may spend a lot on travel, while others merely spend on groceries or takeout.

Analyze your spending habits to maximize your rewards

Take a expect at the past few months of your spending and categorize information technology as best y'all tin can. Ask yourself the following questions: Do yous spend a lot on gas and groceries? How ofttimes practise you lot travel? Can you put piece of work-related purchases on a credit bill of fare and then go reimbursed by your visitor?

Once you figure out which categories y'all're spending the most in, commencement researching different credit carte du jour options that fit your needs. After analyzing your spending, you may find that you lot want to utilise two credit cards to maximize rewards. Withal, while juggling cards can help you earn more rewards, don't get so distracted you terminate up spending more than than you lot usually would.

Empathise cash back vs. points vs. miles

Next, yous should consider which types of rewards you're looking for. In that location are 3 primary types of rewards currency: cash dorsum, points and miles. It may make sense to earn points and miles through travel rewards cards if you like to travel. If yous adopt to earn greenbacks rewards, await at cashback cards instead.

Credit card rewards can be confusing, and most credit cards have restrictions on how you lot can redeem the rewards. For case, some cards crave a minimum redemption threshold, or you may have to await multiple billing cycles to receive your rewards. Consider how much time and effort you lot desire to put in versus getting a simple carte with straightforward options.

Below, we've hand-picked our favorite beginner rewards credit cards that are like shooting fish in a barrel to use and offer fantabulous returns:

| Card | Best for... | Annual fee | Rewards rate |

|---|---|---|---|

| Chase Sapphire Preferred® Card | Travel rewards | $95 | 5x on travel purchased through Chase Ultimate Rewards®, 3x on dining and 2x on all other travel purchases |

| Citi® Double Cash Card – 18 calendar month BT offer | Cashback | $0 | Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional ane% equally you pay for those purchases. |

| Chase Freedom Flex℠ Card | Rotating categories | $0 | 5% cash dorsum on up to $ane,500 in combined purchases in bonus categories each quarter you activate. Relish new 5% categories each quarter! Plus, earn 5% cash dorsum on travel purchased through Chase Ultimate Rewards®, 3% on dining and drugstores, and 1% on all other purchases. |

ValuePenguin's verdict

A credit card can brand or pause your financial future. If used correctly, you'll enjoy a plethora of benefits, from a great credit score to valuable credit card rewards. However, if you fail to manage your credit card responsibly, you may find yourself spiraling out of command and into debt. Knowing the basic principles of using a credit menu tin can avoid the latter outcome entirely and secure a promising outlook for your personal finances.

Source: https://www.valuepenguin.com/how-use-credit-cards

0 Response to "Can You Pay Off a Credit Card Before the Due Date Comes"

Post a Comment